Introduction

Most organisations adopt NetBox for a sensible, technical reason: they need a network source of truth that’s more structured than spreadsheets, more network-native than a generic CMDB, and automation-friendly.

NetBox is explicitly positioned this way: a curated data model plus APIs, intended to define and validate the intended state of network infrastructure and make it programmatically accessible.

That “automation-first” framing is correct… but it’s also incomplete. What often gets undervalued is that once you’ve invested in building a trustworthy infrastructure dataset, you’ve created a strategic asset. Not just a technical inventory.

The key message: customers are building a source of truth for engineering efficiency, but missing the commercial and strategic benefits of the same dataset.

More than a Technical Asset

NetBox’s sweet spot is that it becomes the central registry that automation, monitoring, and assurance tools can reference, without hardcoding device lists into Ansible inventories, YAML files, or one-off scripts.

NetBox itself reinforces this separation of responsibilities: it doesn’t configure devices directly; it defines and exposes authoritative data so other tools can execute workflows. So far so good. The problem is what happens next.

Once NetBox is “working” (i.e., it can drive config generation, populate monitoring, and standardise inventory), organizations often stop. NetBox becomes a technical dependency rather than a business capability.

The Dataset is the Strategic Asset

A NetBox deployment that’s maintained, (where lifecycle states, ownership, dependencies, locations, configurations, and changes are consistently recorded) creates something rarer than automation: it creates decision-grade infrastructure intelligence.

NetBox’s built-in change logging is a clue here: it doesn’t just store “what exists,” it can capture “what changed, when, and by whom,” which is foundational for auditability, planning, and governance.

That makes NetBox useful to more than network engineers. The same dataset can support:

- Lifecycle analysis and refresh planning

- Change impact modelling

- Project outcomes tracking

- Cost allocation, waste reduction, and FinOps

- Risk/compliance narratives executives understand

In other words: NetBox can be the system of record for infrastructure decisions, not just the inventory for infrastructure actions.

Strategic Use Case 1: lifecycle intelligence (refresh, risk, compliance)

A clean asset dataset makes lifecycle analysis almost inevitable: end-of-life, end-of-support, vulnerability exposure windows, hardware standardisation, and prioritised refresh waves.

This is exactly the direction Netos takes with lifecycle reporting: internal references point to “lifecycle analysis” views that report EoX/EoL status.

Why this matters commercially: lifecycle data turns “we need to keep the lights on” into a prioritized, defensible investment plan:

- quantify risk (what is unsupported vs merely old),

- forecast budget timing,

- schedule projects around business constraints,

- negotiate vendor renewals with evidence.

Strategic Use Case 2: modelling change and business/project outcomes

Network changes are rarely “just network changes.” They are usually in service of:

- opening a new site,

- migrating to cloud,

- integrating an acquisition,

- improving resilience,

- enabling a product launch.

- M&A

But organisations often struggle to answer basic questions like:

- Which changes were part of Project X?

- What did we intend to change, and what actually changed?

- What was the operational impact?

- Did the change deliver the expected business outcome?

If NetBox is treated as the intended-state model (not merely documentation), it becomes the anchor for “before/after” comparisons.

Strategic use case 3: FinOps for networks (not just cloud)

FinOps is often described as a discipline/operating model that helps organisations maximise business value from technology spend by aligning finance, engineering, and business stakeholders around data-driven decisions.

Even when “FinOps” is cloud-branded, the underlying mechanics map cleanly onto network and infrastructure:

- allocation (who owns what),

- utilisation (what is used vs idle),

- unit economics (cost per site / per user / per service),

- forecasting (what refreshes or growth will cost),

- optimization (standardisation, decommissioning, vendor consolidation).

NetBox (plus extensions) provides the missing denominator: a trustworthy map of what assets exist, where they are, what role they play, and who they serve. Without that, cost conversations degrade into guesswork and spreadsheets.

The missed opportunity: customers may be paying the “data tax” (keeping NetBox accurate) but only collecting the “automation dividend,” not the “financial and planning dividend.”

NetBox as an Organizational Capability

To unlock strategic value, the goal shifts from “populate NetBox” to operationalise the dataset:

1) Treat data quality as a product KPI

Define what “trustworthy” means (completeness, accuracy, timeliness). Use reconciliation reporting to continuously surface gaps. Netos frames this explicitly as part of maintaining a NetBox technical and financial source of truth.

2) Expand the stakeholder map

If NetBox only serves NetOps, it will stay a technical tool. Bring in:

- service owners,

- security/risk,

- finance/Procurement,

- programme delivery.

3) Tie fields to decisions

Every data element should answer a decision question:

- lifecycle → “what must be replaced and when?”

- ownership → “who pays / who approves?”

- dependency → “what breaks if we change this?”

- status → “is this production-critical or lab?”

4) Build “executive narratives” from technical truth

Executives don’t want VLANs; they want:

- exposure,

- cost,

- timeline,

- The same dataset can generate both, if you design for it.

Different Stakeholders, Different Value

One reason the strategic value of a NetBox dataset is often missed is that engineers and managers look at the same system through very different lenses. For engineers, NetBox answers operational questions: What is the IP? What platform is this? What can I safely automate?

Success is measured in reduced headaches, fewer outages, and cleaner automation pipelines. For managers, however, those details are largely incidental.

They care about why changes are happening, what risk is being carried, how much things cost, who owns the outcome, and whether investment is delivering results.

When NetBox is implemented purely to satisfy engineering workflows, it remains invisible at the management layer. Even though it already contains much of the data leaders need.

The result is a widening gap: engineers see NetBox as indispensable, while managers see it (if at all) as a technical tool, not a decision platform.

Bridging that gap doesn’t require a new system. It requires surfacing the same source-of-truth data in ways that align with managerial questions around risk, cost, lifecycle, and outcomes.

The Dataset is the Compounding Asset

Automation ROI is real, and NetBox is arguably the most network-native, API-first foundation for it.

But the bigger win is compounding: as the dataset improves, it becomes easier to do better planning, better governance, faster delivery, and more credible investment decisions. That’s when “source of truth” stops being a tooling project and becomes a strategic advantage.

The job isn’t just to automate the network—it’s to turn the network dataset into a decision engine.

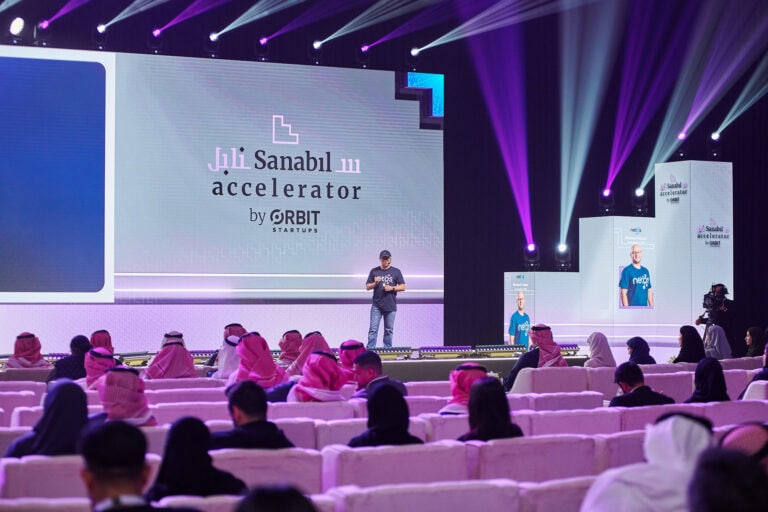

Netos Can Help

Netos helps you unlock the financial and commercial value. Contact Netos to see how fast your network dataset can start paying for itself.

We get the data right – ingest, reconcile, and assure

We enrich it with context – lifecycle, cost, ownership, and business alignment

We turn data into decisions – financial modelling, lifecycle, and on-prem FinOps

We connect IT and Finance – defensible business cases, forecasts, and cost transparency executives understand.